What happens when the TORTOISE and the HARE both run out of gas?

Perspectives on Today’s Bond market and the classic 60/40 portfolio

The current market environment is still challenging.

Isn’t it irritating how financial advisors describe a tanking market as challenging?

For some investors, the current situation may feel even worse because of heavy losses in the bond market. For aggressive investors, bear markets, although tough to swallow, may be easier to understand. If you have 100% of your portfolio allocated to stocks, there is at least some level of expectation that severe market losses can and will happen. It’s goes with the territory.

But what about ‘moderate investors’ those investors in the classic 60/40 portfolio? Or those investors that have any portion of their portfolio in bonds.

The 60/40 portfolio is a classic asset allocation strategy that’s aimed at balancing the upside of stocks with the stability of bonds to, over the long term, take the edge off market volatility.

If investments followed children’s stories, then bonds would be the tortoise and stocks the hare. And we know who eventually won that race right?

Right now, it seems both tortoise and hare are out of gas—or they can’t afford the price of gas.

The design of the 60/40 portfolio reflects an underlying expectation is that bonds will provide a countermeasure to stock losses. Bonds ‘should’ either go up, not lose, or lose almost nothing when stock markets fall. It seems rational. If people are selling their stocks, they need to put the money somewhere. That haven is normally bonds

Until 2022.

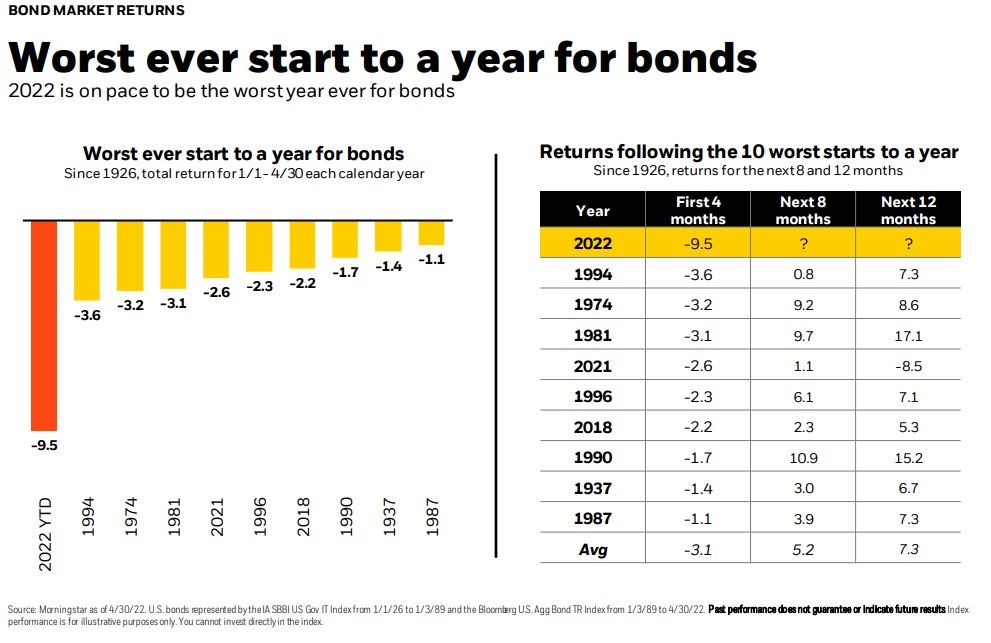

Bonds, are down almost 10% YTD as of this writing. The chart from Blackrock below further reflects the historical nature of the time.

Research shows there have only ever been four years since 1928 when both U.S. stocks (S&P 500) and U.S. bonds (10-year treasuries) finished the same year in negative territory — 1931, 1941, 1969 and 2018. *

In an article written by Ben Carlson entitled ‘Things you see in every bear market**” he states:

“In every bear market, some asset class, strategy or investment doesn’t behave like it’s supposed to. Diversification itself often gets called into question. In the 2008 crisis it was housing. No one really thought housing could crash on a national basis. It was quite rare but stuff that never happens seems to happen all the time when it comes to the markets. This time around its bonds.”

Does this mean diversification is broken? Is the 60/40 portfolio dead? Or…is just a really strange time because the response to the pandemic sent interest rates crashing to the lowest levels in history, followed by inflation and now rising interest rates.

I’ll let you be the judge but I’m confident you know where I stand.

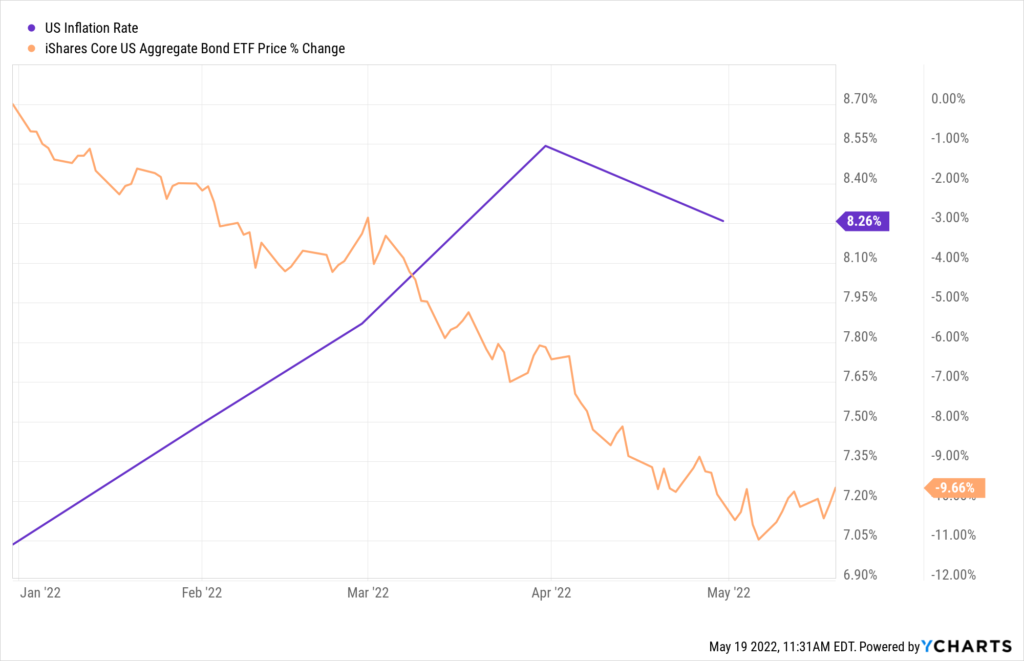

The last two years have seen an extraordinary upheaval in the world and the markets. It would be an understatement to say there have been ton of ‘firsts’ since February 2020. Right now, one of the ‘firsts’ we are dealing with is high inflation. And to combat inflation the Fed is rapidly raising interested rates.

When interest rates rise, bond prices fall. The chart below reflects the YTD rise in inflation the corresponding fall in bonds.

I realize that words don’t take away the sting of losses. However, this does not mean the bonds, diversification or the 60/40 portfolio is broken. Only that we are going through a season unlike any other.

Rest assured, we are monitoring the situation and making adjustments are needed. We always look to take advantage of a bad situation be that rebalancing portfolios or tax loss harvesting.

But what we aren’t doing is throwing our fundamentals out the window because of a bizarre situation. We aren’t panicking. We are not chasing a ’hot investment.’

Hopefully you aren’t either. ????

As always, if you need anything, we are here, watching, researching and adjusting.

*Source: Ycharts

Securities and advisory services offered through LPL Financial, a registered investment advisor.

Member FINRA/SIPC.

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.”

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Asset allocation does not ensure a profit or protect against a loss. All indices are unmanaged and may not be invested into directly