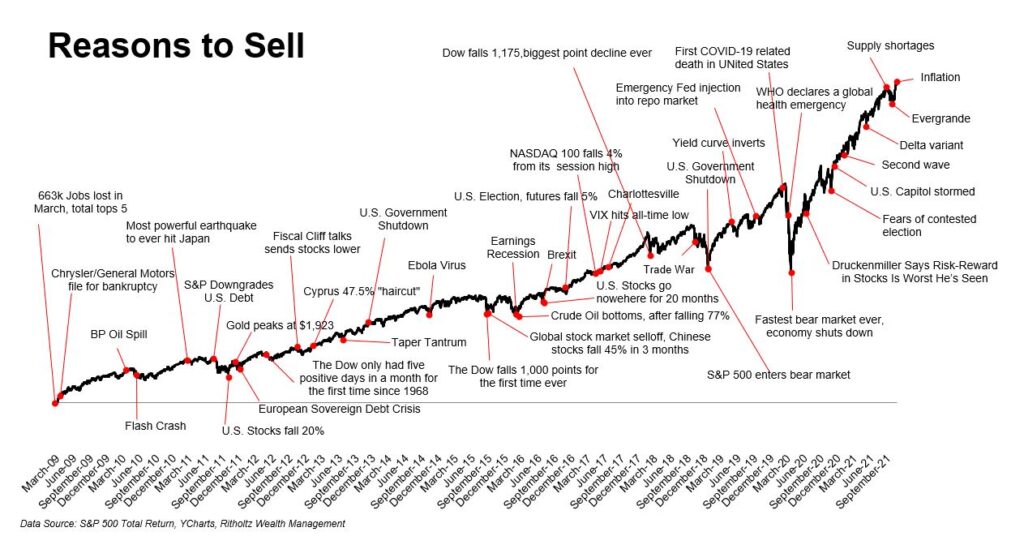

There is always a reason to sell.

It’s official, the SP500 is now in bear market territory. Just like last time, and the time before, and the time before that.

A two-year bull run in stocks that began at the depths of the coronavirus panic came close to crashing into a bear market Friday but avoided that fate in the last hour of trading.

What’s driving this? The stubbornly high inflation and the aggressive response for the Federal reserve to get it under control. (And throw a little Russia/Ukraine war into the mix as well)

Does this mean we should sell?

Perhaps, or perhaps not. Just like the chart above illustrates, there is ALWAYS a reason to sell!

Which one of these ‘reasons’ is your favorite?

Remember Brexit? Government Shutdown? Trade Wars? Contested Presidential Elections?

Before we had Covid we Ebola? Remember when a barrel of oil went negative? Now gas is almost 5.00 a gallon.

How about the Flash Crash? The stock market fell 9% in a matter of minutes. * In today’s term, that’s about a 3000-point drop.

Taking a closer look at the chart reveals something interesting.

Despite all of the negative news, the line on the chart seems to go up and to the right. There is always a reason to sell. But in the past, there were more reasons to hold.

Presently, The S&P 500 is having its WORST START TO THE YEAR SINCE 1939. ** The bond market is also off to a record setting start. Heck, the Detroit Tigers are doing better than either stocks or bonds.

Today’s bear market may have you contemplating detonating your portfolio. Undoubtedly, markets like this take a toll on investor psyche.

“Let’s just NOT LOSE money!” I’ll wait for the market to settle down and get back in later.” (You might be saying)

Before we do that, let’s put things into perspective.

Since January 1st, 2020, the S&P 500 has returned +25%

Despite…

- A global pandemic

- The fastest 30% drop in stocks EVER (22 days)

- 8%+ inflation

- An overseas war

- Multiple interest rate hikes

- Matthew Stafford winning a Super Bowl.

Some pretty good reasons to sell right?

Buying low and selling high is easier to understand, but very hard to do in reality.

Right now, we are having a hard time imagining future that doesn’t resemble the recent past. Look at the chart again. Clearly we’ve had rough times. We will keep having rough times.

However, gas won’t be at 5.00 a gallon forever. Inflation will eventually subside. And just like the stock market can’t return 16% per year (like from 2019-2022) it also won’t return lose 20% per year (like it has now)

With all of the negative news filling the airwaves shouting “do something!” It’s my hope that this specific perspective gives you some peace of mind and patience to stick to the plan.

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.”

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Asset allocation does not ensure a profit or protect against a loss. All indices are unmanaged and may not be invested into directly

* https://en.wikipedia.org/wiki/2010_flash_crash

** https://www.cnn.com/2022/05/02/investing/stocks-sell-may-go-away/index.html